Abstract:

Modern mortgage law is designed for a world that no longer exists. The residential mortgage transaction of today looks nothing like it did during the formative period when the property laws governing mortgages were developed. What was once a local dealing between two individuals and largely for commercial or quasi-commercial purposes has now become a housing- centric financial transaction-turned-asset between multiple distant and often invisible parties that operate as part ofa national market. Yet, although the mortgage transaction has changed, mortgage law has not. Property law rules that once balanced the rights of mortgagors and mortgagees now completely fail to furnish aggrieved mortgagors with meaningful relief when faced with wrongs that stem from the complexities of the securitization of mortgage loans and the acts of intermediaries. The result is that consumers suffer wrongs at the hands of mortgage creditors and their contractors but have no remedies to right them. This is particularly true in light of the economic fallout from the COVID-19 pandemic and the threat of a coming wave of foreclosures that, if the 2008 financial crisis is any indication, promise to leave households vulnerable and completely at the mercy of the mortgage finance machine. This Article shows why an overhaul to mortgage law’s most basic doctrines is long overdue.

Commentary:

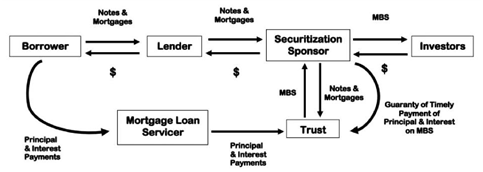

This article is an excellent history of mortgages, starting with Roman and Anglo-Saxon law through later English developments and then the rise of modern mortgages in the United States with the FHA, Fannie Mae and Freddie Mac and securitization. As to the last, the article provides a clear and concise explanation of how mortgages are securitized:

Securitization Structure Basics

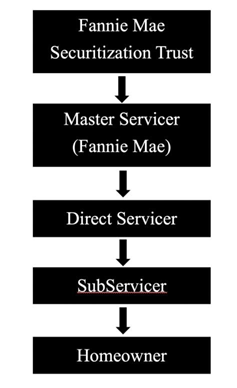

Even more interesting is when the article points to the problems that have arisen as the often medieval conceptions on which mortgage law have evolved and metastasized into the current system. The article identifies the bifurcation that has occurred with the separation of the mortgage holder and the mortgage servicer, with the latter having been selected without any choice by the borrower. This is actually more accurately described as "trifurcated" or even "quadrificated" as shown here:

GSE Single-Family Mortgage-Backed Securitization Servicing Structure

This tiered structure muddies accountability by shearing the agency relationship, which often makes it nearly impossible to establish that the Trustee is ultimate responsibility and liability in mortgage litigation for failures and malfeasance by a SubServicer. While in most TILA litigation, vicarious liability is imputed from a servicer to the Trust, that generally fails in RESPA litigation with only the servicer liable for its bad acts. This breakdown cuts against borrowers in the opposite direction when servicers fail to properly offer loss mitigation options, with many courts finding that the servicer owes no duty to the borrower, but only to the Trust.

To remedy this problem, with it attendant economic, psychological and societal harms, the article advocates for the recognition of a Doctrine of Equitable Privity of Estate base on a recognition that under property law there exists a privity throughout the tiers of a securitized mortgage. This would impute a duty on all parties to act in good faith and to be liable for the actions of all parties acting on their behalf.

There is, however, a saying that when you're a hammer, the whole world looks like nails. And as something of a bankruptcy hammer, I look at this article and wish it examined mortgage law as bankruptcy nails. Much of the litigation in the wake of the Housing Crisis occurred in bankruptcy courts, but that venue goes largely unmentioned. Particularly as bankruptcy courts are court of equity, the Doctrine of Equitable Privity of Estate might best be advanced there. That this aspect remains unaddressed could hopefully be itself remedied in future articles.

For a copy of the article, please see:

Blog comments